Corporate

Governance

Information on our corporate governance is posted here.

Information on our corporate governance is posted here.

Information on our corporate governance is posted here.

1.Our company’s Management Philosophy is that “The OHARA Group continually seeks to instill new value and build a strong organization for the purpose of advancing the well-being of its people and contributing to the prosperity of society,” and we conduct our business activities in accordance therewith. OHARA endeavors to streamline internal organizational structure and administrative schemes and take necessary measures to realize the above Management Philosophy.

Moreover, toward our various stakeholders including shareholders, customers, employees and local communities, OHARA strongly believes that fulfilling responsibility as a public instrument of society will maximize our corporate value, and management with transparency and soundness in line with our corporate philosophy is the best approach to corporate governance.

2.We will work to enhance our corporate governance in accordance with the following ideas.

(i)We will respect the rights of shareholders and ensure equality.

(ii)We will consider the interests of our stakeholders, including our shareholders, and cooperate with them appropriately.

(iii)We will appropriately disclose company information and ensure transparency.

(iv)The Board of Directors conducts highly effective supervision of management and directors from an independent and objective standpoint.

(v)We will strive to enhance two-way communication in order to achieve constructive dialogue with shareholders with a purpose.

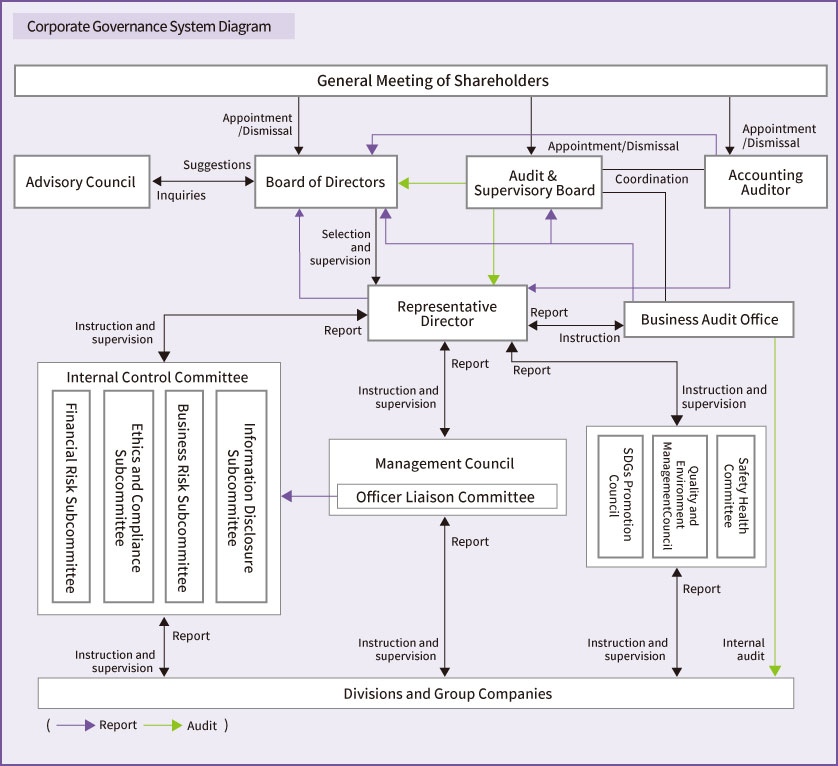

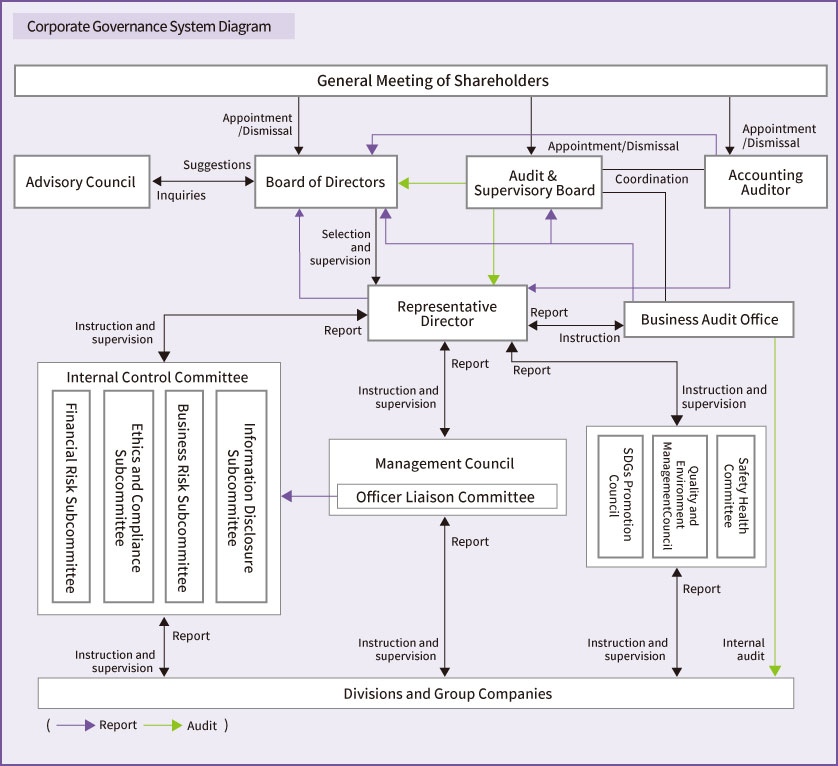

OHARA reviewed its internal control system and worked to strengthen the operation of the internal control system.

Previously, the Internal Control Committee, Ethics and Compliance Committee, Risk Management Committee, and Information Disclosure Committee were in parallel and independent committees. However, under this system, there is a risk of omissions or duplication of management, and we have regretted that comprehensive and efficient internal control is not sufficient for the entire group. Therefore, we integrated the functions of these committees into the Internal Control Committee, and set up four Dubcommittees: Financial Risk Subcommittee, Ethics and Compliance Subcommittee, Business Risk Subcommittee, and Information Disclosure Subcommittee. .

Through this system, we will enhance comprehensive and efficient internal control over the entire group.

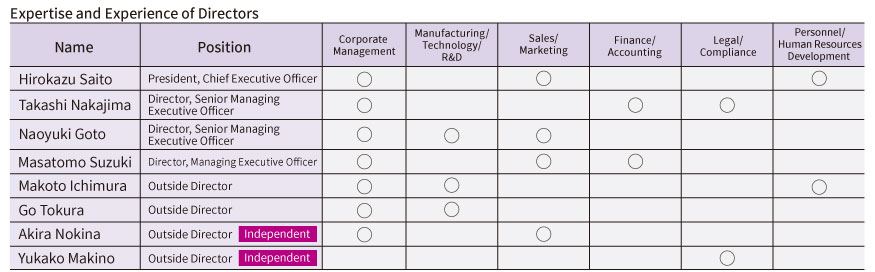

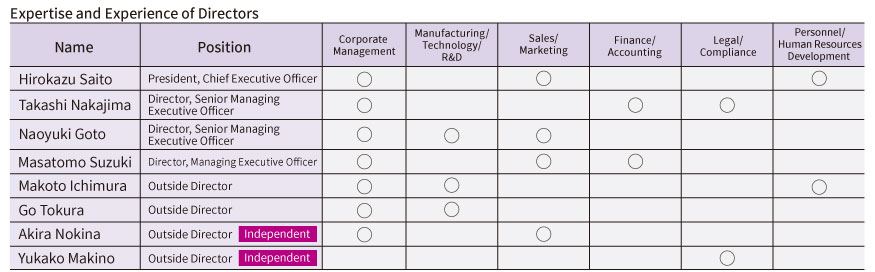

The Board of Directors consists of eight directors and meets once a month in principle. As a management decision-making body, the Board makes decisions on important matters such as management policies and supervises the execution of duties by directors and executive officers. The Board of Directors currently consists of four full-time directors and four outside directors (including one female).

Two of the outside directors are independent outside directors.

OHARA evaluates the effectiveness of the Board of Directors in accordance with its Basic Policies on Corporate Governance. In the analysis and evaluation for FY 2021, full-time officers (directors and audit & supervisory board members) made self-evaluation based on a questionnaire, and then opinions of independent outside directors were heard, after which the Board of Directors had discussions and carried out analysis and evaluation by referring to the collected results.

A summary of the results of this analysis and evaluation follows. With regard to the streamlining of reporting items, which was identified as an issue in FY 2021, we confirmed that improving the explanations provided in advance led to a positive effect to a certain extent. On the other hand, while there was some discussion on challenges surrounding sustainability, the need for further study was recognized. Therefore, we will make further efforts for adequate advance preparations,

information exchange and awareness sharing, and increase opportunities for discussion on management issues, thereby enhance the effectiveness of Board of Directors’ meetings.

The Advisory Council is established as a voluntary body and consists of the chairman of the Board of Directors and three independent officers (two independent outside directors and one independent outside audit & supervisory board member). It works to ensure management objectivity and transparency by deliberating and reporting on matters regarding the appointment and dismissal of senior management (executive officers concurrently serving as directors), appointment of directors and audit & supervisory board members, and remuneration of directors.

The Internal Control Committee, chaired by President and Chief Executive Officer, has been established to check and strengthen the status of internal controls whose four purposes are to improve the effectiveness and efficiency of operations, ensure the reliability of financial reporting, comply with laws and regulations, and preserve assets. There are four subcommittees under the Internal Control Committee: the Financial Risk Subcommittee, the Ethics and Compliance Subcommittee, the Business Risk Subcommittee, and the Information Disclosure Subcommittee. The Internal Control Committee monitors internal controls of the OHARA Group as a whole, including these subcommittees.

◦ Financial Risk Subcommittee

The Financial Risk Subcommittee is in place to establish and build a system for ensuring the appropriateness and efficiency of the OHARA Group’s operations as well as the reliability of financial reporting. The subcommittee considers and supervises action plans and measures to improve the effectiveness and efficiency of operations and ensure the reliability of financial reporting.

◦ Ethics and Compliance Subcommittee

The Ethics and Compliance Subcommittee is in place to establish an ethics and compliance system for the OHARA Group as a whole and to realize corporate governance that fulfils its social responsibility through the execution of fair and appropriate business activities. The subcommittee practices the OHARA Group’s philosophy based on its corporate principles by providing educational programs related to ethics and compliance to raise awareness about legal compliance and ethics and prevent iniquity.

◦ Business Risk Subcommittee

The Business Risk Subcommittee is in place to effectively and efficiently manage risks of the OHARA Group. The subcommittee designs policies, systems, and measures pertaining to the Group’s risk management, raises awareness about the prediction and prevention of potential risks, formulates and operates annual risk management plans, conducts overall coordination of risks of departments and subsidiaries, and studies measures to minimize damage in the event of crises.

◦ Information Disclosure Subcommittee

The Information Disclosure Subcommittee is in place to disclose important financial, social, and environmental management-related information about the OHARA Group in a fair, timely, and appropriate manner. The subcommittee fulfils corporate accountability and ensures management transparency by considering whether a specific piece of management-related information constitutes a material fact that should be disclosed and taking appropriate measures.

Related information can be viewed by following the links below.

The contents about Investor Relations are explained.